fundamental risk affects closed end funds in which of the following ways

Compared with open-end products the ability of CEFs to use leverage can increase volatility. Wiesenbergers survey has published end-of-year fund prices and net asset values since 1943.

Ppt To Understand What Are Mutual Funds For Bba Finance And Mba Finance Students Powerpoint Slides

2009 the FDIC closed more than 100 banks for the first time since 1992.

. Please see above for ways to contact the Division. But it also increases a funds volatility. Multiple Choice A stock is overpriced but your fund does not allow you to engage in short sales.

O ne of the fundamental concepts in finance is arbitrage defined as the simultaneous purchase and sale of the same or essentially similar security in two different markets for advantageously different prices Sharpe and Alexander 1990Theoretically speaking such arbitrage requires no capital and entails no risk. 1 discussed in Section 4. Item 341 of Form N-2 requires a closed-end fund to undertake to suspend its offering of shares until it amends its prospectus if the funds net asset value declines more than 10 from the funds net asset value as of the effective date of its registration statement.

Swing pricing is widely used in Europe but not in the US although its use was authorized by the SEC in 2018. But the risk-benefit ratio calculations being used dont seem to be including previous infection. And this was typically historically this has typically been from preferred shares or from debt.

Debenture bonds are backed by the income from a specific project 1 only 2 only Both 1 and 2 Neither 1 nor 2. When an arbitrageur buys a cheaper security and sells a more. CEF strategies often focus on less liquid asset classes and markets that are not.

Mutual fund information is derived from forms NQ quarterly and NCSRs annually. QUESTION 91 Which if any of the following statements is are correct. Higher volatility.

Examples of closed-end funds include. Another reason is that many closed-end bond funds use leverage which pumps up their income. Funds that have a portfolio with a significant allocation.

Fundamental research is critical for a full understanding of the risks and opportunities that ESG factors. Closed-end funds CEFs can be one solution with yields averaging 673. Ways to decrease risks include diversifying assets using prudent practices when underwriting and improving operating systems.

A funds objective is stated in its prospectus. In addition where possible holdings information is obtained directly from mutual funds on a more frequent basis. Shares of closed-end funds frequently trade at a market price that is a discount to their NAV.

An investor may purchase or sell shares at market price. This buying and selling could result in higher fees and increased taxes if you hold the fund in a taxable account. The overall risk of a closed end fund is based on its investment strategy and the objectives of the fund.

To this end risk communication and perceptions bridge lay peoples understanding of risk within risk management methods and techniques Fig. A lot of the funds in the closed-end fund space use leverage. A fund that invests in a blend of stocks and bonds will likley be more risky than a fund that invests in micro-cap stocks.

Their yields range from 632 on average for bond CEFs to. Closed-end funds are more likely than open-end funds to include alternative investments in their portfolios such a s futures derivatives or foreign currency. Just like open-ended funds closed-end funds are subject to market movements and volatility.

Closed-end funds may trade at a discount or premium to their NAV and are subject to the market fluctuations of their underlying investments. Wiesenbergers annual survey of mutual funds Investment Companies Services. When selling an open-end fund the price the seller receives is established at the close of the market when the NAV is calculated.

Financial risk has to do with the amount of leveraging or the use of borrowed funds that a firm utilizes to structure its investment and finance its asset. Moreover the first edition of the survey contains end-of-year fund data from 1933 to 1942. Mutual funds typically offer more diversification and less risk than purchasing one or two individual securities.

The major risks faced by banks include credit operational market and liquidity risks. Insider Ownership data which reflects changes in ownership by directors officers and principal stakeholders comes from filings of Forms 3 and 4. Closed-end funds are subject to management fees and other expenses.

Basically it allows the manager of an open-end fund to adjust its net asset value. Which one of the following best describes fundamental risk. Closed funds may allow no new investments or they may be closed only to new investors allowing current investors to.

The fund manager does not separate ESG issues from the rigorous analysis conducted for each and every investment which seeks to generate risk-adjusted return. Changes in interest rate levels can directly impact income generated by a CEF. Unlike the open-end fund a closed-end fund has a limited number of shares outstanding and trades on an exchange at the market price based on supply and demand.

Multiple Choice A stock is overpriced but your fund does not allow you to engage in short sales. We would like to show you a description here but the site wont allow us. Which of the following combines some of the operating characteristics of an open end fund with some of the trading characteristics of a closed end fund.

Prudent risk management can help banks improve profits as they sustain fewer losses on loans and investments. As of year-end 2011 813 banks appeared on the FDICs list of problem institutions up more than an order of magnitude from a mere 76 as of year-end 2007 but down from a high of almost 900 as of year-end 2010. A closed fund may stop new investment either temporarily or permanently.

The benefit of using Wiesenbergers data is that one can examine a longer period. ESG analysis is integrated into each of the stages of the investment process. And unlike regular open-ended.

Because closed-end funds can trade at discounts or premiums to net asset value they are more volatile than the equivalent open-end fund says advisor and money manager Leland Faust author of A. And during 2009 2011 a total of 397 banks failed. The value of a CEF can decrease due to movements in the overall financial markets.

Ppt To Understand What Are Mutual Funds For Bba Finance And Mba Finance Students Powerpoint Slides

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Ppt To Understand What Are Mutual Funds For Bba Finance And Mba Finance Students Powerpoint Slides

Closed End Fund Cef Vs Exchange Traded Fund Etf Study Com

Behavioral Finance And Technical Analysis Ppt Download

Wondering About Closed End Funds Learn A Few Basics Ticker Tape

Ppt To Understand What Are Mutual Funds For Bba Finance And Mba Finance Students Powerpoint Slides

Federal Register Securities Offering Reform For Closed End Investment Companies

Investor Sentiment And The Closed End Fund Puzzle Lee 1991 The Journal Of Finance Wiley Online Library

What Is The Difference Between Closed And Open Ended Funds Quora

What Is The Difference Between Closed And Open Ended Funds Quora

Chapter 1 Understanding Investments Learning Objectives Define Investment And Discuss What It Means To Study Investments Explain Why Risk And Return Ppt Download

Ppt To Understand What Are Mutual Funds For Bba Finance And Mba Finance Students Powerpoint Slides

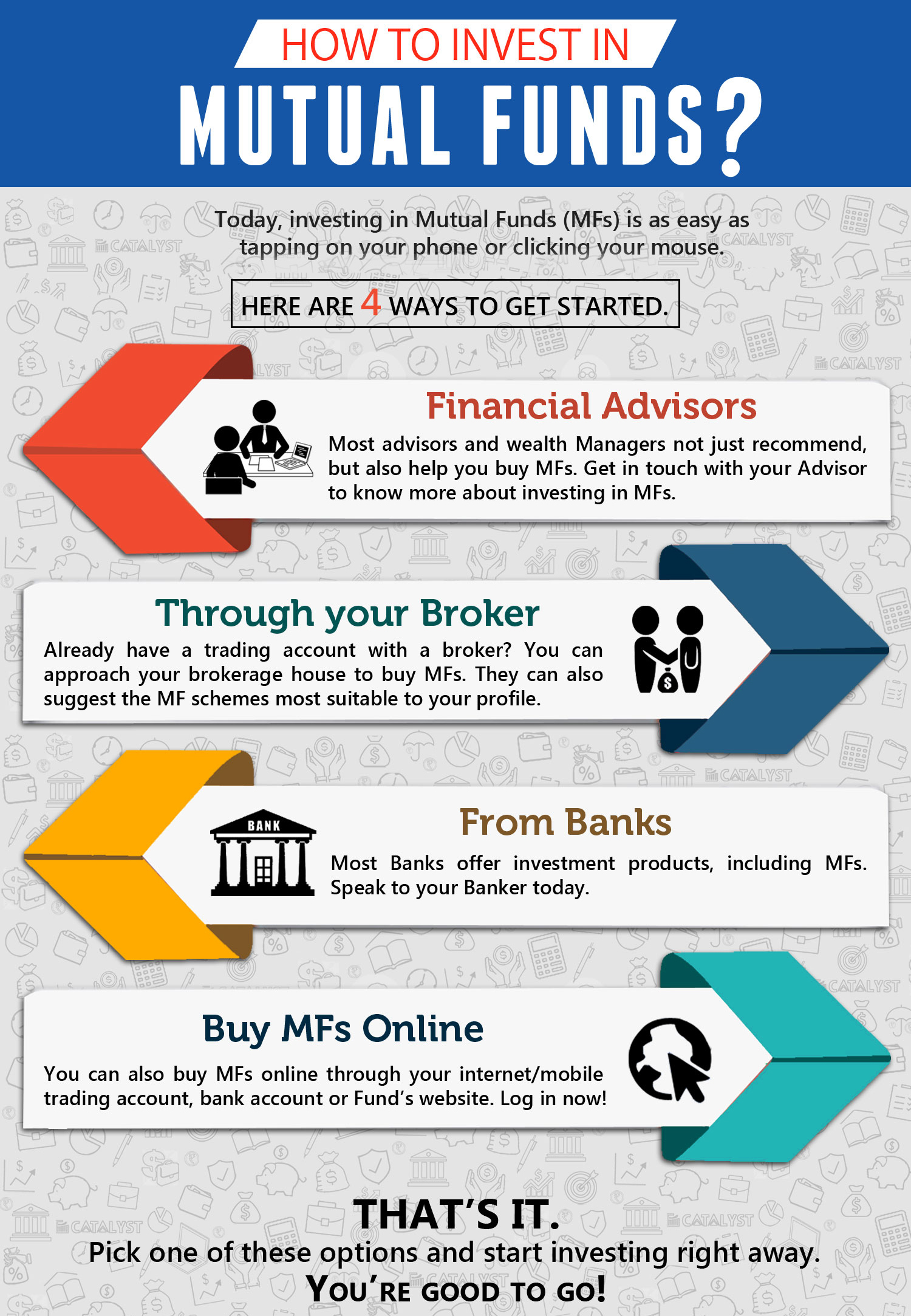

How To Invest In Mutual Funds Jamapunji

What Is The Difference Between Closed And Open Ended Funds Quora