amazon flex after taxes

You are required to provide a bank account for direct. With Amazon Flex you work only when you want to.

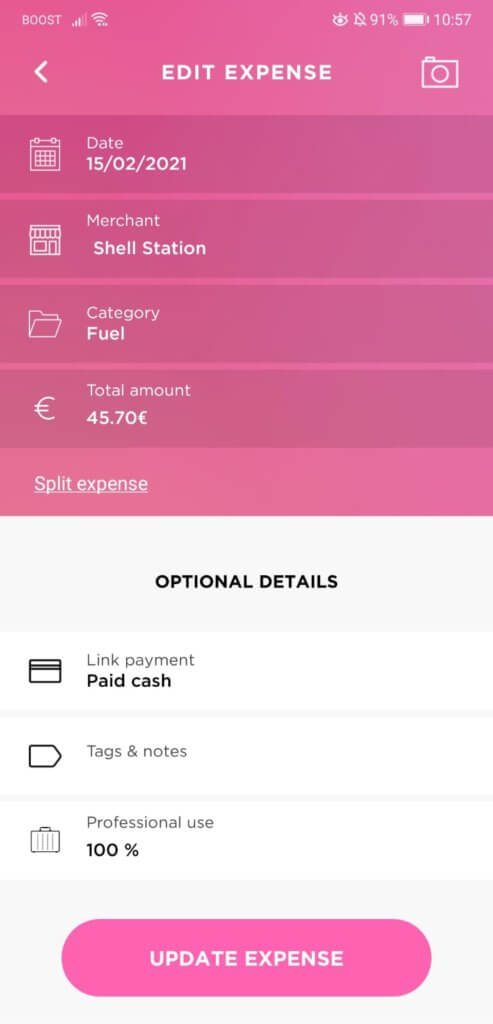

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

But instead of it taking you four hours to make all of your deliveries you managed to make them in three hours.

. There are no set hours for this job. It has 25 stars. If you have records of oil changes and other car maintenance maybe you can figure out the average miles per.

You can make closer to 25 per hour by using a larger car which makes you eligible to deliver more packagesAnother option is to claim blocks during busy times which are marked in the. Pickups from local stores in blocks of 2 to 4 hours. With Amazon Flex you work only when you want to.

After you sign up to deliver for Amazon Flex youll use the app to start scheduling and making your deliveries. And Amazon pays you 25 an hour so 100 for the whole block. You can plan your week by reserving blocks in advance or picking them.

Amazon Flexs website claims you can earn anywhere between 18-25 per hour by making deliveries from Amazon warehouses or partner restaurants. Look into paying estimated taxes because none is being withheld -- or the IRS will get testy with you read. In your example you made 10000 on your 1099 and drove 10000 miles.

Unfortunately not everyone has had a wonderful experience with Amazon Flex and there are a fair amount of negative reviews. Youre an independent contractor. First you work on the days.

Youre not considered an. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. This form will have you adjust your 1099 income for the number of miles driven.

Ad We know how valuable your time is. With Amazon Flex Rewards you can earn cash back with the Amazon Flex Debit Card enjoy Preferred Scheduling and access thousands of discounts as well as tools to navigate things like insurance and taxes. We know how valuable your time is.

They have a list of all the major cities including Austin Chicago Cleveland Dallas. Amazon Flex quartly tax payments. Only available in limited areas these deliveries start near your current location and last from 15.

Amazon wants customers to be able to get their merchandise within an hour no matter what day of the week it is. Knowing your tax write offs can be a good way to keep that income in your pocket. Driving for Amazon flex can be a good way to earn supplemental income.

These comprehensive benefits begin on day one and include health care coverage paid As an independent contractor you will use the information on form 1099 from Amazon. Amazon Flex Reviews Online. Amazon Flex Driver Current Employee - Houston TX - November 12 2019.

Please be sure to arrive. It usually takes about 2-5 business days to hear back from Amazon and once you are accepted there are basically two ways to go about the delivery. Get started now to reserve blocks in advance or pick them daily based on your schedule.

Here are a few things to know about scheduling in the app. So they provide different shifts to drivers. This is really no different than any other gig app except that Amazon only takes so many people at.

First go to Amazon Flex website and select the city you want to work in. Businesses such as partnerships S corporations or LLCs that are taxed as partnerships are required to file taxes by March 15 2022. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on.

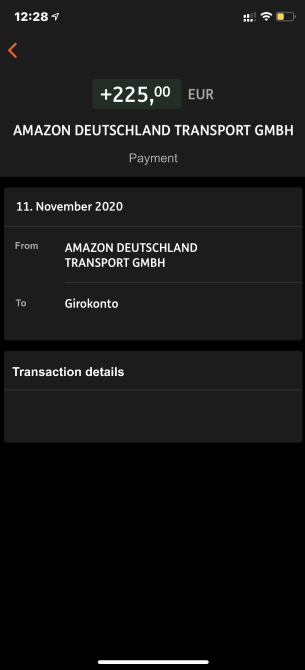

However once you are vested it triggers a tax liability and you will pay ordinary income taxes on the amount of gain between fair market value FMV at grant and FMV at. Amazon Flex pays out earnings on a weekly basis for base pay and tips for the previous 7 days on every Wednesday. The Amazon Flex app provides the start location at least 1 hours before your block start time and also provides suggested turn-by-turn navigation to get to the location.

Individuals C corporations sole. Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. Maybe you guess that your average is so many miles per day.

Fine you in the spring because youll. Adjust your work not your life.

How To Do Taxes For Amazon Flex Youtube

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To File Amazon Flex 1099 Taxes The Easy Way

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Amazon Flex Be Your Own Boss Great Earnings Flexible Hours Be Your Own Boss Extra Money Work From Home Moms

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

![]()

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tax Deductions Tracking App Mileage

How To File Amazon Flex 1099 Taxes The Easy Way

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Does Amazon Flex Take Out Taxes In 2022 Complete Guide

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Get Paid To Drive Without Picking Up Strangers Amazon Flex Pays 15 An Hour And Up Side Gigs Pr Newswire Make Quick Money Online

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable